CBDCs Are CLOSER Than You Think: 108 Countries Are Currently Doing THIS In 2023!

As we watch Operation Chokepoint 2.0 strangle the crypto industry, many people are wondering whether these are the early signs that our central planners are working on closing the escape valves before rolling out a CBDC…

That statement could sound slightly conspiratorial, but it’s awfully interesting to observe that as our global financial system crumbles today in 2023, 105 countries from all around the world are suspiciously working to deploy a CBDC.

As more and more of our lives are moving from the analog world into the digital world, we’ve watched a lot of our information and communications digitized through the adoption of the internet.

This digitization and democratization of information and communication has already radically transformed our modern society. It’s inevitable that our value, in the form of money, will eventually be digitized through this technological revolution.

Governments and central planners are now joining the race to create a digital currency as the world continues to digitize, and our central planners believe that they’ve stumbled upon a solution for the digital age, with their version of digital money, called a ‘Central Bank Digital Currency’ (CBDC).

Our central planners believe they’ll be able to continue to profit, control, deceive, and extend their existence with CBDCs before the inevitable Bitcoin standard takes hold.

That’s their plan, but let’s look at how advanced their ideas are.

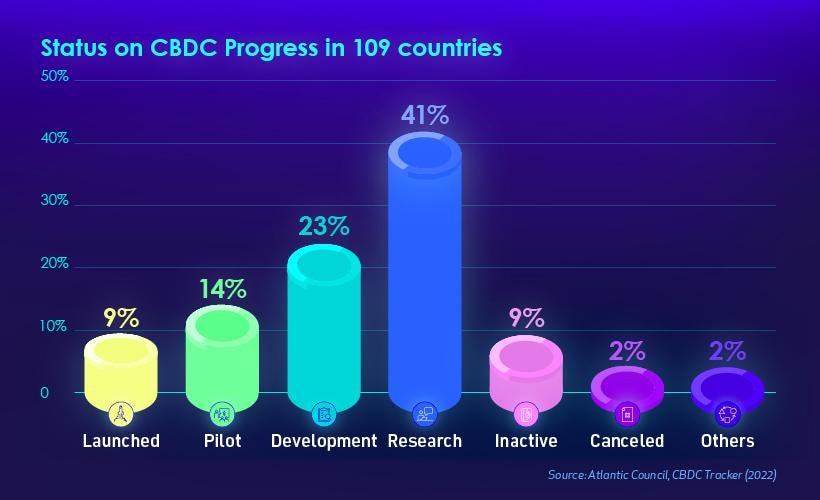

We can see that of these 105 countries, 41% are currently in the research phase, 14% have a pilot program, and 9% have launched a full scale CBDC.

https://www.atlanticcouncil.org/cbdctracker/

Together, these countries represent over 95% of global GDP, meaning it’s nearly impossible to find a developed country to live in that’s not exploring a CBDC.

95% of global GDP seems high considering there’s around 70 countries not exploring a CBDC?

This can be explained by the fact that countries not exploring CBDCs are typically less developed (impoverished in most cases), and don’t have the technological capability to roll one out.

So, from a locality-centric viewpoint, it could prove difficult to avoid CBDCs, but what about timeframes?

How close are these CBDCs to being rolled out?

The website below ranks the over 100 CBDCs from around the world that are currently in the works, based on their level of maturity.

The Bahamas was the first country to launch a CBDC, issued by the Central Bank of The Bahamas in October 2020.

The Sand Dollar is a digital version of the Bahamian Dollar.

The Caribbean islands appear to be a region of the world that has seen a proliferation of interest in CBDCs.

DCash, is the digital currency issued by the Eastern Caribbean Central Bank (ECCB), which is also a very interesting option in the region.

It is used by 7/8 of the countries that are included in the Eastern Caribbean Currency Union (ECCU).

These countries include Antigua and Barbuda, Dominica, Grenada, Montserrat, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines.

These countries received quite the shock earlier this year in January when the popular DCash project went offline for 2 months, once again highlighting why we can’t trust centralized CBDCs.

This image highlights another corner of the world that the freedom-loving individuals should look to avoid in the coming years.

Asia looks to be another test bed for CBDC tyranny, as the pink on the map below shows the proliferation of CBDCs about to be deployed in the region.

Taking a closer look, we can see countries such as China, Thailand, Malaysia, and South Korea already have pilot programs launched.

Chinese officials have given us yet another reason why we should be skeptical about CBDCs.

Everyone loves to talk about their social credit score system, however, the digital Yuan is taking George Orwell’s vision of 1984 a step further.

It’s rumored their CBDC will come with an expiration date.

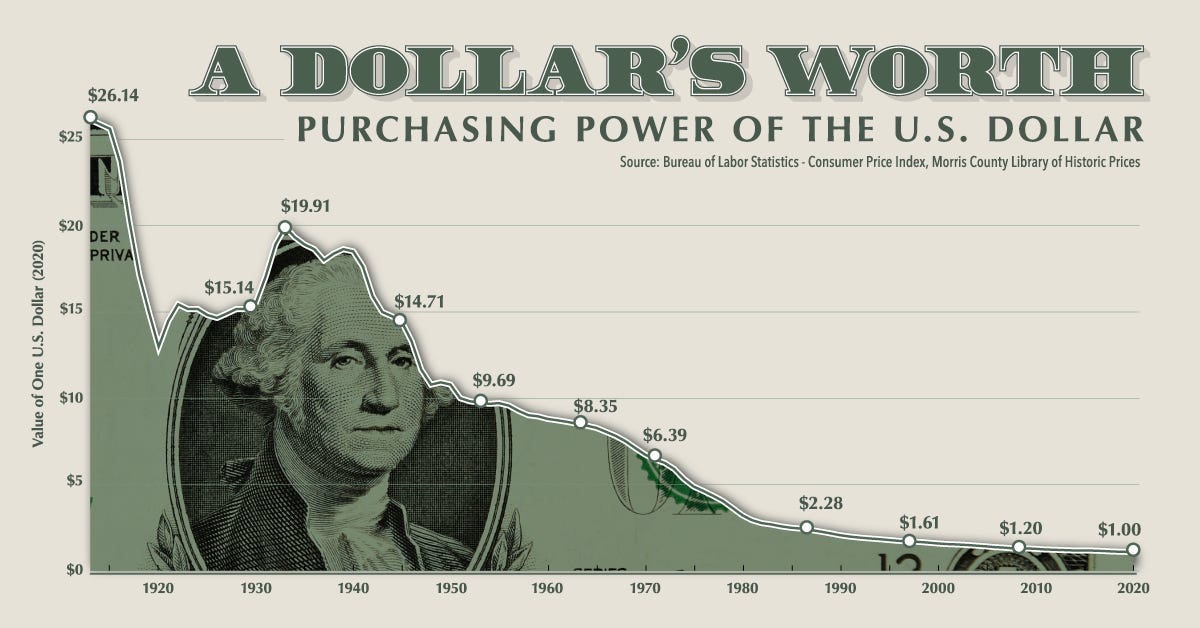

We already have out-of-control inflation that makes your money worth less every year, but now you need to spend it or have it expire.

Turning our attention to the West, Europe seems to be leading the race to deploy a CBDC.

Many countries in the area such as Sweden, Ukraine, and Lithuania have already deployed a pilot program.

France also recently announced that they’ll have a wholesale CBDC ready to launch this year.

The US also appears to be moving towards a CBDC, with the recent "Fed-now" announcement declaring it ready by mid-2023.

Interestingly, Jerome Powell has also said that a digital Dollar will help maintain United States dominance globally.

The current de-dollarization movement that we continually speak about will make the geopolitical conversation surrounding CBDCs all the more interesting in the coming years.

If CBDCs take too long to ship in the US, will the US government simply nationalize the existing US Dollar stable coins?

I think it’s interesting that the $50B USDC stable coin is already 100% backed by US treasury debt…

We’ll explore that rabbit hole another day.

Irrespective of the direction the USA takes in its CBDC approach, many government officials in the country are actively jockeying to steer the country in the direction they desire.

Elizabeth Warren for example, has continued her long war against Bitcoin, coming out recently declaring she’s building an “anti-crypto army.’’

Is it any surprise that she’s also been an advocate for CBDCs in the past?

If you made it this far into today’s read, you’ll probably love the video we recently recorded on this topic today.

Conclusion:

The ramifications of these rapidly approaching surveillance tools is going to affect your life in drastic ways. If CBDCs are implemented by states around the world, will we see the World Economic Forum’s (WEF) prediction for 2030 become a reality?

“By 2030, you’ll own nothing. And you’ll be happy.”

Whether you give any credence to what the WEF says or not, I’m sure we can all agree on a few things.

Our money is only going to become more digital.

Our governments don’t have a solution to the globe’s unsustainably high debt burden.

Their only solution is to print more currency units and further debase our money, which has already lost over 99% of its value in our lifetimes.

The past 100 years of monetary history should highlight the fact that we shouldn’t trust our central planners with the responsibility to create the digital money we use in the digital age.

Early warning signs that emerged in recent years only confirm this.

China is experimenting with an expiry date for their CBDC.

The Canadian freedom convoy participants had their bank accounts frozen.

This is why we believe the world needs Bitcoin.

Bitcoin is the only viable asset to counter these assaults on our freedom in the digital age.

It offers individuals an unconfiscatable savings account that they

can truly “own and be happy’’ with.

If you made it this far into today’s read, you’ll probably love the video we recently recorded on this topic today.

You can watch the video that we produced on this topic over on our “Money Matters’’ YouTube channel.