Bitcoin Was JUST HIT With FIVED COORDINATED ATTACKs This week!

Two mysteriously timed +30 page reports were just dropped within 3 days of each other last week, which I believe proves a Co-ordinated Bitcoin attack is silently accelerating…

The US, Europe, Italy, Norway, and France have all been making moves against Bitcoin in the past week couple of weeks, and I don’t think it’s a coincidence…

From calls to ban Bitcoin, to global tax grabs, the pressure is clearly building, and your chance to get onboard the Bitcoin lifeboat could be slowly slipping away.

Strap in, this is what I have for you this week:

Two of the largest central banks ATTACK Bitcoin!!!

France, Italy, and Denmark coordinating with their G7 piers?

The holey Suisse cheese solution: Why your Plan B might only be 33% as sovereign as you think.

Estimated read time: 0.75 blocks (7 minutes and 30 seconds)

The U.S. Federal Reserve Wants to Shut Bitcoin Down

On October 17, the Minneapolis Federal Reserve dropped a bombshell in their new 40-page white paper, saying

‘‘Governments need to tax or ban Bitcoin, to continue running permanent budget deficits.’’

Yeah, you read that right.

They’re terrified of Bitcoin because it threatens them with a wild new term they created in the paper, called: ‘‘The “Balanced Budget Trap.”

What does that mean?

Simple — Bitcoin forces governments to balance their budgets, something they’ve avoided for decades, as they’ve piled on $35 trillion of debt…

They’ve even piled on $1 trillion more debt in just the past few weeks. So, yeah, the government’s in trouble, and Bitcoin is making their life even harder, which is wild to see them admit publicly.

The U.S. government is running out of options, and they’re realizing that Bitcoin could be the escape valve, but their not the only multi trillion dollar central bank mysteriously attacking Bitcoin now…

ECB: ‘‘Bitcoin Impoverish’s Society.’’

Just one day after the Fed’s paper on October 18, Europe jumped in with its own 30-page report. And guess what?

They’re coming after Bitcoin too, but from a different angle.

Europe’s not just worried about the economics — they’re now claiming Bitcoin’s rise is “fueling the division of society.”

Yes, seriously, they actually said that, publicly, but there’s even MORE jaw dropping quotes from this strangely timed report…

The EU is framing Bitcoin as a societal disruptor, arguing that ‘’the wealth generated by early Bitcoin adopters could cause inequality.’’

Basically, they’re saying Bitcoin could tear society apart by making the rich richer and leaving everyone else behind.

It’s classic fear-mongering, but the timing is no coincidence.

Two massive reports from the U.S. and Europe, both targeting Bitcoin, in less than 48 hours?

This isn’t random.

It’s the same playbook we’ve seen before in every empire and currency collapse in history. The only question that remains are:

1) Why are we seeing this attack now and

2) Will this collapse see a little bit of a modern twist with CBDCs implemented?

To answer those questions we simply need to look at what the 9th largest country is doing…

The 9th largest country, Italy, Doubles Capital Gains Tax on Bitcoin

Italy just went all in, nearly doubling its capital gains tax on Bitcoin from 26% to 42%. Think about that for a second. They’re not just looking to squeeze a little extra revenue—they’re coming after Bitcoiners, treating Bitcoin as both a threat and a cash grab.

This isn’t a one-off either…

Europe’s ramping up tax policies across the board, and it’s no secret that Bitcoin wealth is in their crosshairs.

Denmark Introduces the World’s First Unrealized Capital Gains Tax on Bitcoin

Denmark just took things to the next level by introducing an unrealized capital gains tax on Bitcoin—the first of its kind.

Yes, holy Sh*t.

Here’s what this means:

If Bitcoin’s value rises, Danish holders will have to pay 42% tax on those gains, even if they don’t sell a single sat.

This is a new level of government reach into Bitcoin wealth, taxing gains on the very idea of holding it as a store of value.

Imagine this: Bitcoin doubles, and suddenly, you’re forced to sell off a chunk just to pay taxes on a profit you haven’t even realized yet.

Does this man you then have to ALSO pay tax on the Bitcoin you were forced to sell?

Denmark’s move signals a bold new phase of government intervention in Bitcoin

It attacks the core of Bitcoin’s store-of-value purpose and could force Bitcoiners to liquidate against their will. Denmark isn’t messing around—they want a piece of your unrealized gains, and they want it now…

But they’re not alone…

France’s Global Tax Grab

To top it off, France recently decided to make history.

They’re attempting to become the 3rd country in the world to introduce citizenship-based taxation, meaning French citizens will now be taxed on their global income even if they don’t love in the country.

Yep, no matter where you go, France is coming for your money.

Meanwhile, Norway recently tried something similar, and their new and revolutionary tax strategy backfired in a big way.

Norway recently raised taxes on the wealthy by 1.1%, expecting to pull in $148 million in additional revenue.

But instead, the fourth-richest man in Norway left for Switzerland, costing the country over $160 million in lost taxes, from one person alone.

And it didn’t stop there—Norway has now lost nearly 100 millionaires and about $40 billion in capital as a result of this policy.

Norway’s experience serves as a warning: governments can keep raising taxes, but Bitcoin holders and high-net-worth individuals are finding ways to escape.

The timing of all of these events shows a united front from the West, each looking to assert its control over citizens’ wealth as Bitcoin adoption grows.

Governments are going broke, and they’re tightening the screws on anyone they think might slip through the cracks, but there is good news, or a solution amongst all of this tyranny.

The Holey Suisse Cheese Solution

I’ve described my Bitcoin set up of 2020 as the Suisse cheese of Sovereignty.

Most people hear the word ‘’Suisse,’’ and immediately associate that word with the banking safe haven Switzerland, and assume my set up was sound…

They would be wrong…

A distinguishing feature of Suisse cheese is the fact it has holes in it, like my Bitcoin security plan of 2020.

I had all the financial sovereignty in the world, but was trapped inside Australia for 2 years, becoming a prisoner in my own country. The irony of the situation knows no bounds, considering Australia was founded as a prison colony in the 1800s, but that’s neither here or there…

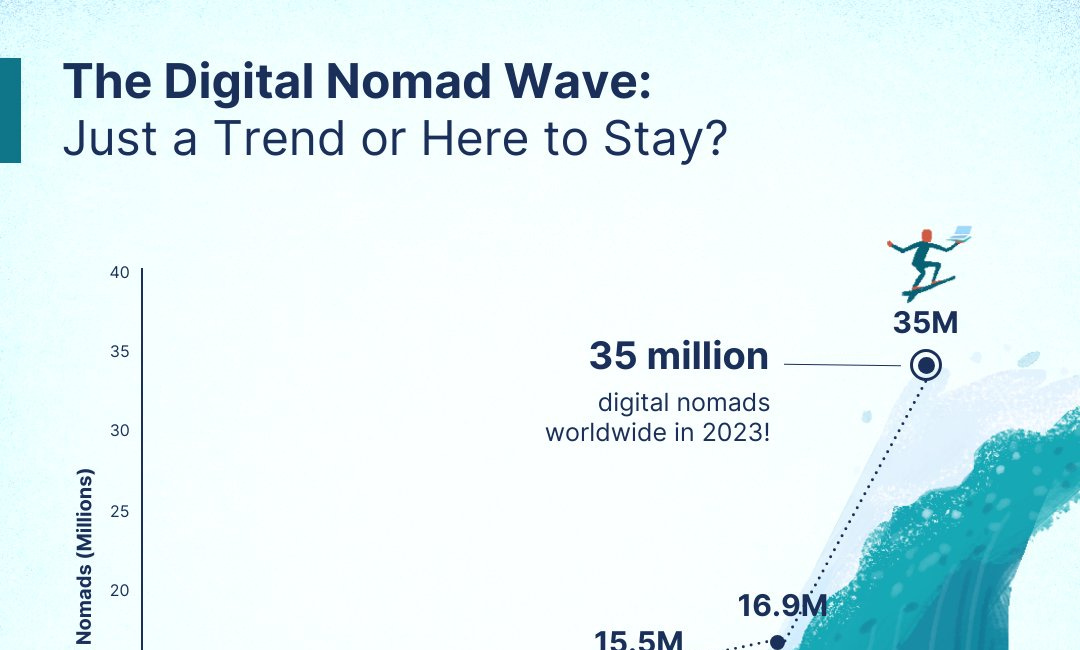

Back to the point at hand, I believe Bitcoiners are only 33% of sovereign as the digital renaissance man.

To learn more about why I believe you will only gain true sovereignty through leveling up your geographical and entrepreneurial sovereignty, check out the link below to read a little more about my new book that’s coming soon:

‘‘The Digital Renaissance Man.’’

ANNOUNCEMENT: The Digital Renaissance Man Book Is Coming

While I may not have been as active on here as I normally am, I wanted to share that my new book is getting closer…

Until next time,

Luke